Bailouts for the Rich, the Virus for the Rest of Us

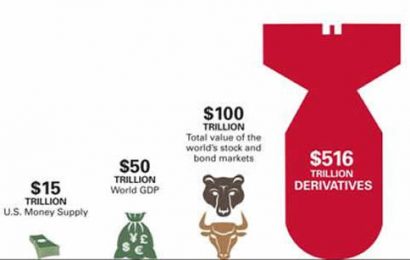

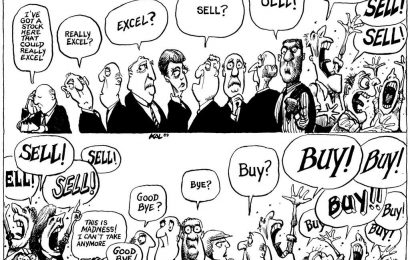

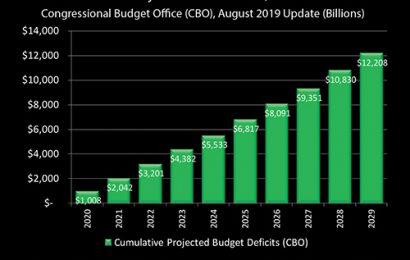

For the second time in a generation, the President and Congress are creating an artificial economy under the guise of ‘saving the economy.’ Through bailouts for the executives of corporations and institutions whose coffers have been emptied for their own...