Hedge Fund Flows Are All That Matter

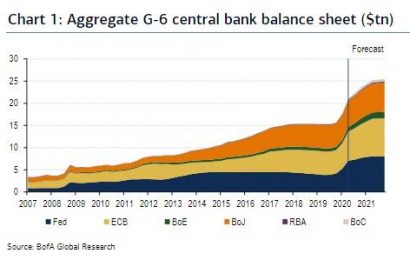

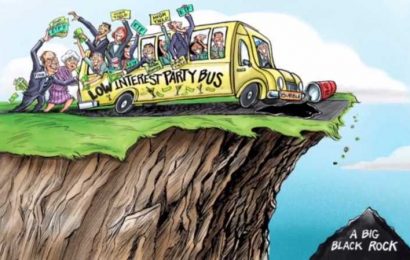

Hedge Fund Flows Are All That Matter, New Study Finds. With every passing day, the bizarre central banks orchestrated freakshow that was once known as the “market” gets even more bizarre. And we use the term “market” in its loosest, legacy sense,...