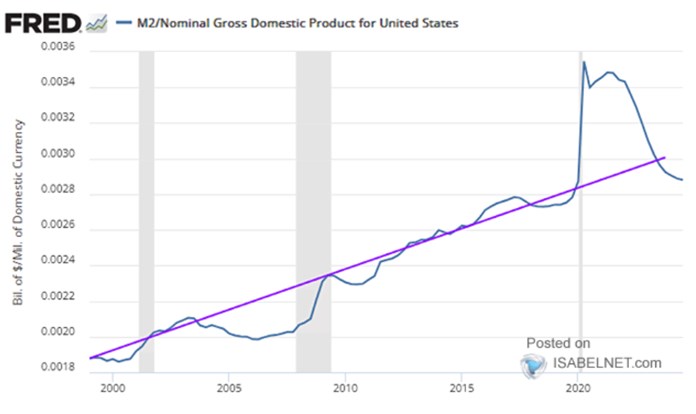

The chart from FRED shows the ratio of M2 to the nominal product of the US economy. It also shows the trend, where the correlation was visible especially after the Global Financial Crisis until 2020. After this period, the money supply relative to the product rose significantly as the FRS together with the government tried to prevent the collapse of the US economy. At the same time, it was a time of significantly increasing inflationary pressures and interest rates.

M2 is both declining and below trend. Which indicates a disinflationary environment and the question of whether the stock market will continue to grow at an unsustainable pace.

Source: FRED