While Wall Street is being torn apart by fierce debate whether the upcoming “six or seven” in rate hikes coupled with $2.5 trillion in QT over the next two years will blow up US capital markets, overnight China showed how trivial such debates are when it published its latest monthly credit data which showed that in January, the Chinese financial system injected just shy of $1 trillion in total new credit.

Four months after we wrote that “China Credit Growth Finally Bottoms, Setting Stage For Powerful Credit Impulse Bounce”, and just weeks after China’s credit impulse indeed bounce staged a powerful move higher just as we had forecast.

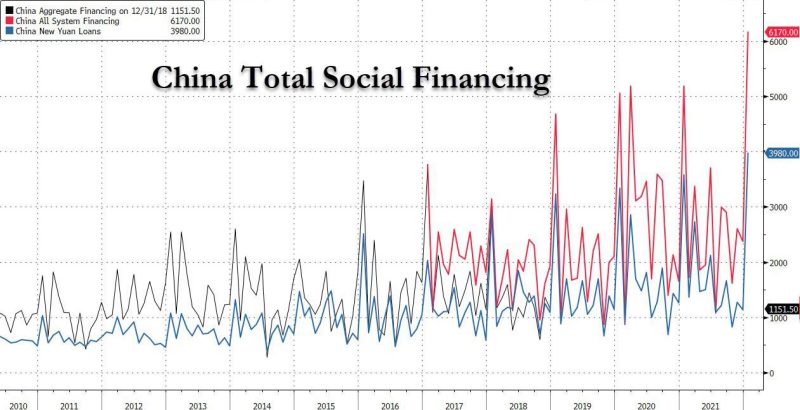

In January Beijing showed just how serious it is about rebooting the stalling Chionese economy, when the latest amount of total social financing and RMB loans accelerated materially and blew away market expectations. Indeed, as shown below, both new TSF and RMB loans were the highest on record with the former surging by a 6.170 trillion.

As a reminder in recent months, PBOC cut RRR, policy interest rates and LPR, and also guided commercial banks to accelerate loan extensions. Sector-level RMB loan growth data painted a less positive picture than the headline figures, as short-term loan growth was still faster than medium-to-long term loan growth, and household medium-to-long term loans only showed a modest acceleration. Last but not least, M2 growth exploded to the upside as well, blowing away expectations.

Here are the highlights:

Total social financing: RMB 6,170bn in January, vs. consensus: RMB 5400bn.

New CNY loans: RMB 3980bn in January vs. RMB 3700bn. Outstanding CNY loan growth: 11.5% yoy in January vs December at 11.6% yoy.

TSF stock growth: 10.5% yoy in January, higher than 10.3% in December. The implied month-on-month growth of TSF stock picked up to 13.9% from 9.4% in December.

M2: 9.8% yoy in January vs. Bloomberg consensus of 9.2% yoy, and up from December’s 9.0% yoy

Needless to say, January total social financing was well above expectations. The sequential growth of TSF stock accelerated to 13.9% mom annualized S/A in January from 9.4% in December after clear easing signals from PBOC and a policy rate cut in January. Overall RMB loans growth remained relatively solid at 10.3% mom annualized sa. M2 year-on-year growth also surprised to the upside and rose 9.8% yoy in January.

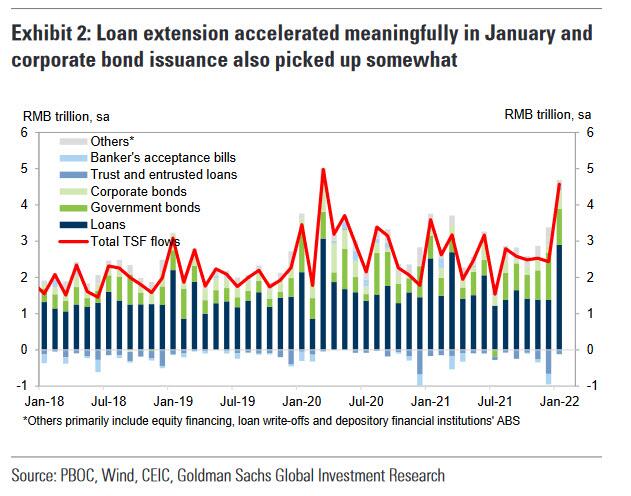

Among major TSF components, loan extension picked up meaningfully and shadow banking credit also showed a much smaller contraction. Based on loans to different sectors, corporate short-term loan growth accelerated to 22.3% mom annualized from 2.9% in December. Corporate mid-to-long term loan growth remained roughly unchanged at 10.6% mom annualized in December. Corporate bill financing rose further by 34.6% mom annualized following a sharp surge of +61.7% in December. On loans to household, short-term loans grew 8.4% mom annualized (vs. 8.3% in December), while household mid-to-long term loan (mostly mortgages) growth picked up to 10.0% mom annualized (vs. 9.5% in December). Government bond issuance slowed slightly in January while corporate bond issuance accelerated. The drag from shadow banking credit (trust and entrusted loans, bank acceptance bills) was smaller in January – after adjusting for seasonality, shadow banking credit contracted by RMB40bn in January, vs an average of RMB 470bn contraction in the prior three months.