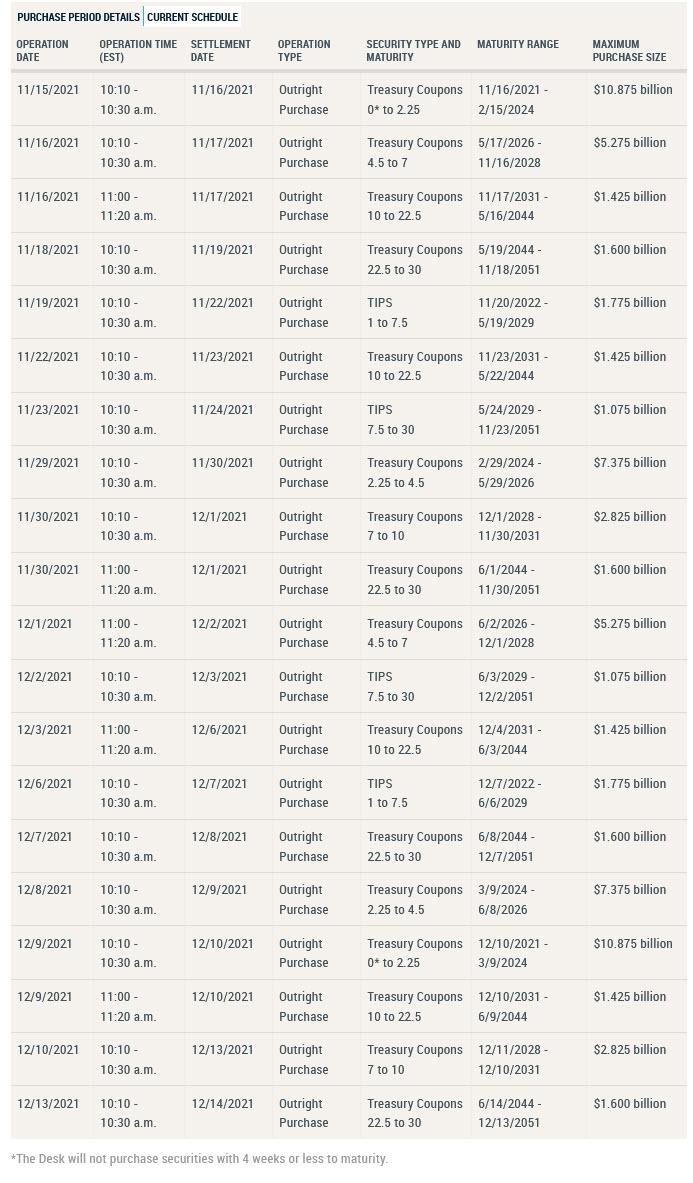

After announcing it would do it two weeks ago, day ago the NY Fed published its first post-taper POMO schedule, which sees a drop from $80 billion in TSY purchases, a number which had been flat ever since the spring of 2020, to $70 billion.

As previously, the purchases focus on the short-end and, well, taper at long-end – for example on Monday the Fed will buy $10.875 in 0-2.25 year coupons, a number which drops to just $1.6bn on Friday when the Fed purchases bonds in the 22.5-30 year bucket.

The declines from prior month POMOs are in proportion to the overall decline in monthly bond purchases.

As is customary, the POMO schedule concludes in the second week of December, on Dec 13 to be precise, at which point the monthly bond purchase total is expected to drop to $60 billion. Whether or not the pace of monthly tapering continues at a pace of $10BN per month in January and onward will depend on how hot (or cold) inflation is over the next 2 months.