After a year of clamping down on new credit card, mortgage, and commercial loan issuance in the aftermath of the COVID pandemic, US commercial banks are planning to issue credit cards to people with no credit scores.

WSJ reports JPMorgan, Wells Fargo, and US Bancorp, and others will extend credit to people who cannot obtain a credit card. Instead of using credit scores to vet an applicant, these banks will use other factors, including checking or savings accounts, to increase their chances of being approved.

Sources told WSJ the pilot program to give credit cards to people with no credit would begin this year. There was no mention of the start date.

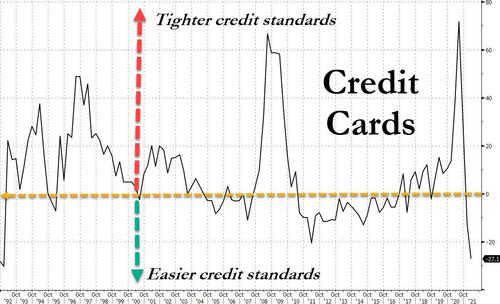

This comes as consumer lending standards have never been this loose since around the time records began in 1991, while auto loans are similarly among the loosest on record.

As explained by WSJ’s source, the pilot program aims at “individuals who don’t have credit scores but who are financially responsible.”

According to Fair Isaac Corp., the creator of FICO credit scores, some 53 million American adults don’t have traditional credit scores. Many are often rejected by banks and have to use payday loans, a costlier way to finance money.

A 2015 report by the Consumer Financial Protection Bureau said Black and Hispanic adults in the US have higher probabilities of lacking credit scores than White or Asians. So perhaps the new pilot program by the fat cats on Wall Street opens the credit spigot to minorities.

More details about the program include JPMorgan might approve a credit-card application from a person who has a checking account at Wells Fargo but doesn’t have a credit score.

JPMorgan is expected to be the first to use the deposit-account data to extend credit to people.

Wall Street’s push to flood credit cards to people who don’t have credit scores comes as consumer credit explodes higher, and it’s never been easier to obtain a plastic card.