In a recent note from SocGen’s Andrew Lapthorne, the cross-asset strategist summarizes the ongoing market insanity delightfully, saying that “there is an increasingly large number of weird and wonderful signs of market excess, from surging crypto currencies started as a joke to a single New Jersey Deli trading at $100m market cap.”

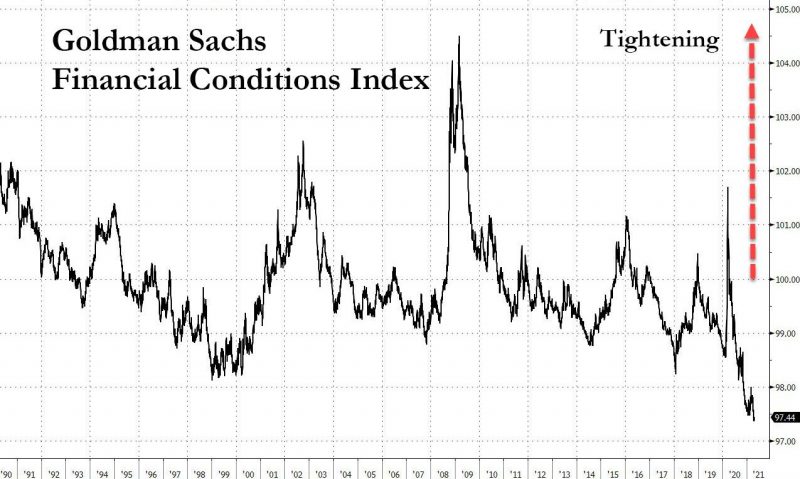

To be sure, it’s not just the record liquidity that has pushed the Goldman index of financial conditions to record easy levels there is also a lot of good news, with the economic narrative improving and vaccination programs accelerating worldwide, with most now hoping that the worst of the pandemic is behind us. At the same time, global profit expectations are being revised upwards and earnings growth is forecast to jump by a third in 2021.

Given this almost euphoric market backdrop, Lapthorne correctly notes that “anything bearish is met with groans.”

But to complete the record, the SocGen strategist adds that even after this profit rebound, global equities will be trading at over 21x earnings, which is extremely expensive on most historical measures, and at a stock level, “the distribution of valuations is as extreme as during the 1999 tech-bubble.”

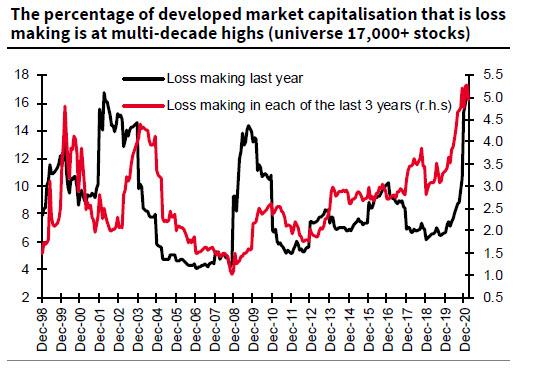

Finally, the amount of global market capitalization that has reported a negative profit number in the last year and in each of the last three years is higher than at any point during the past 22 years, and has even surpassed the dot com bubble.