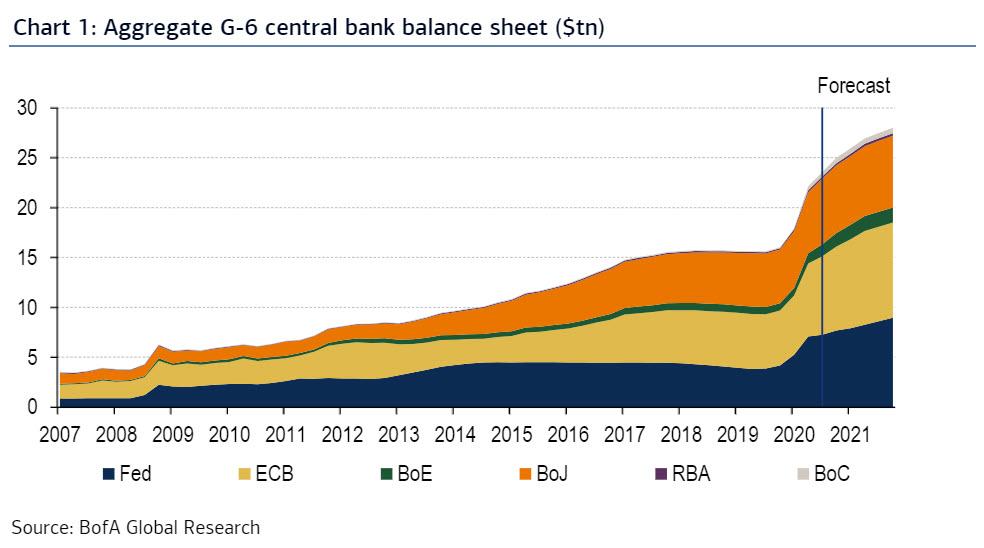

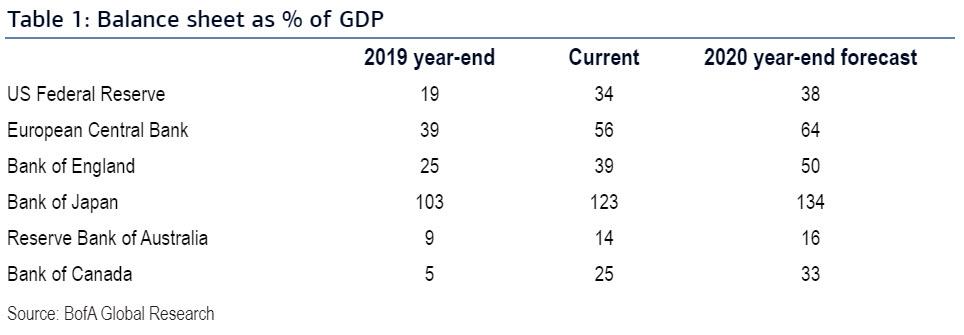

As Bank of America shows, central bank balance sheet have never been bigger with the Fed now holding 34% of US GDP, and expected to see this number rise to 38%. For the other central banks the number is 25% for Canada and 123% for Japan.

Putting an actual number to the liquidity firehose, central banks have injected $24 trillion, or about a quarter of global GDP, into the market to keep it from crashing and expectations are that this number will increase to $28 trillion by the end of next year (this excludes the tens of trillions in assorted liquidity instruments in China). That would be a very optimistic expectation.

And since these days chart inflation means that one picture is worth a trillion words, here is focus on the visuals as they are self-explanatory.

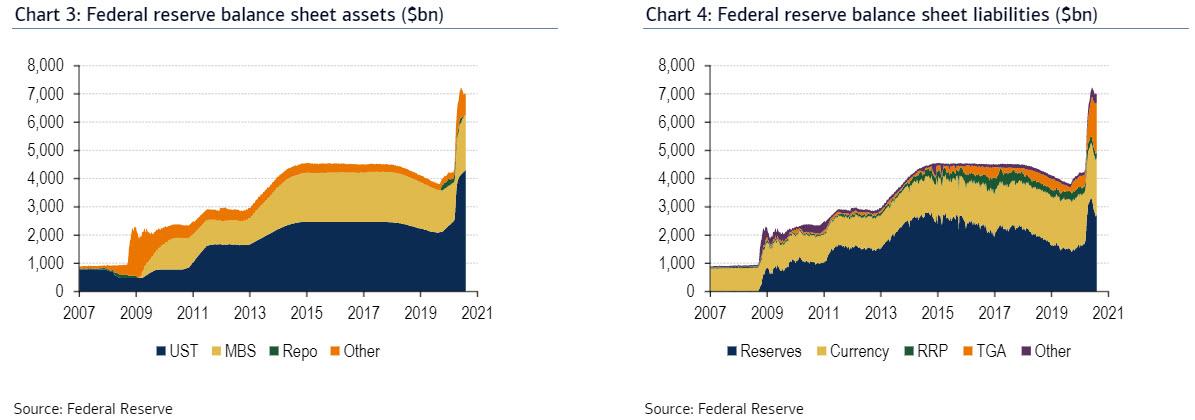

FED

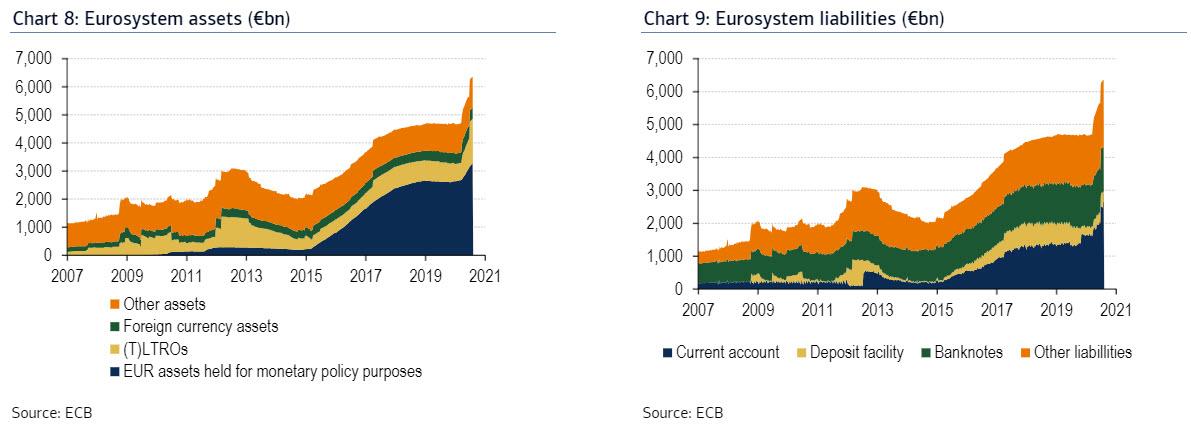

ECB

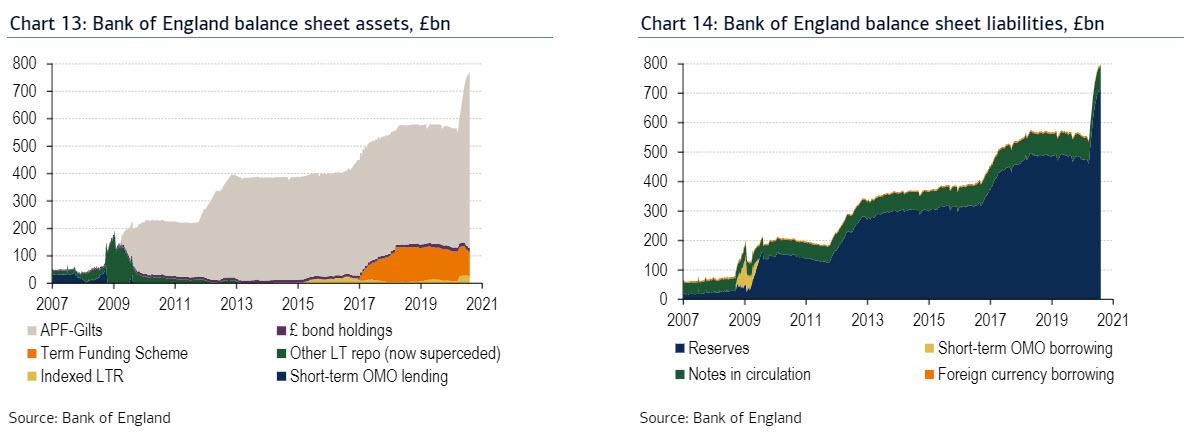

BoE

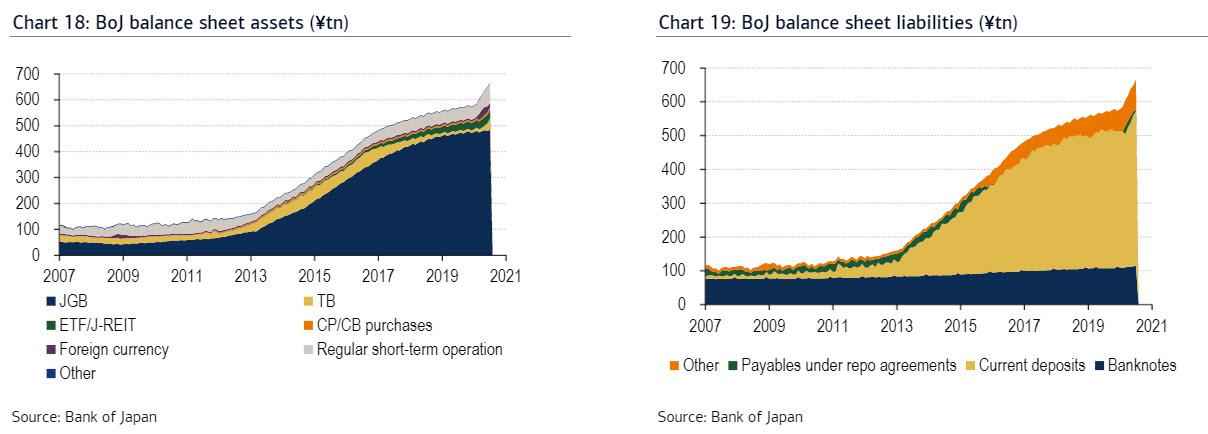

BoJ

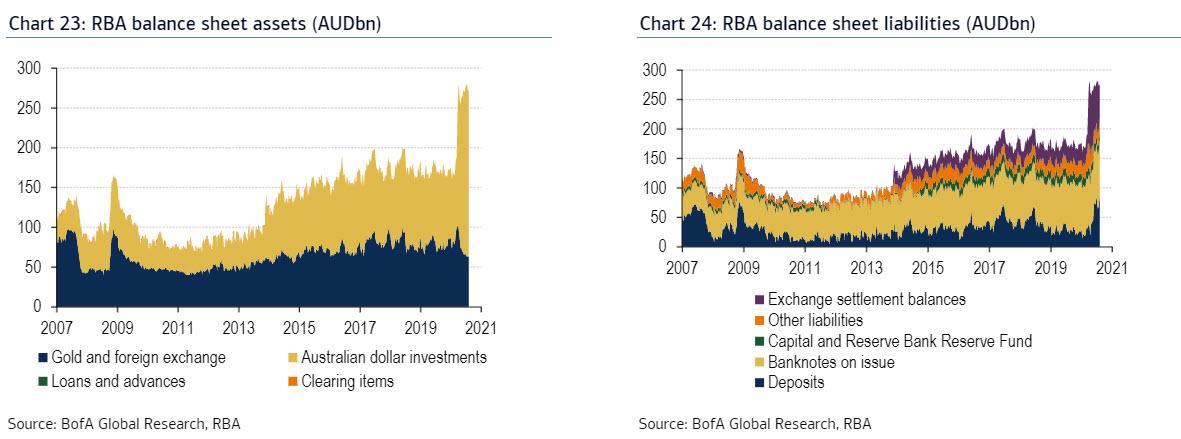

RBA

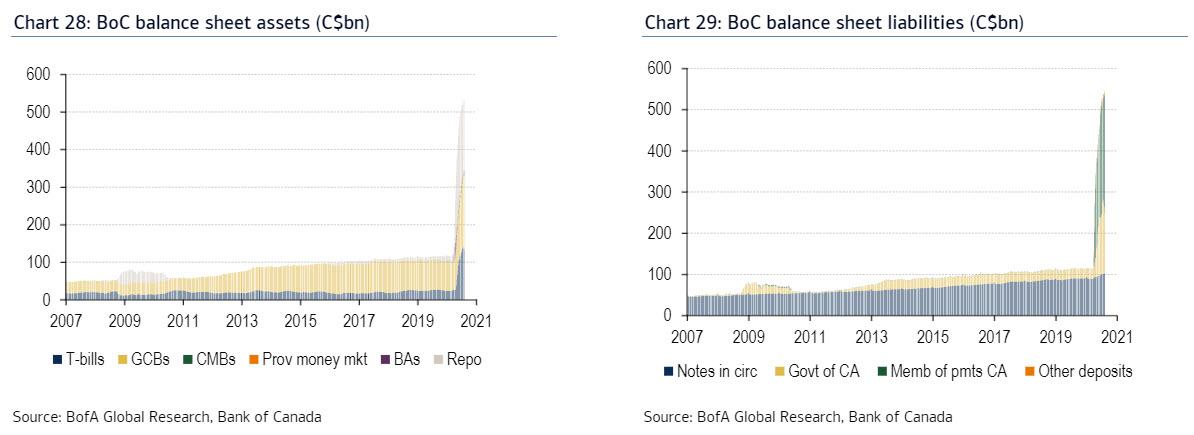

BoC