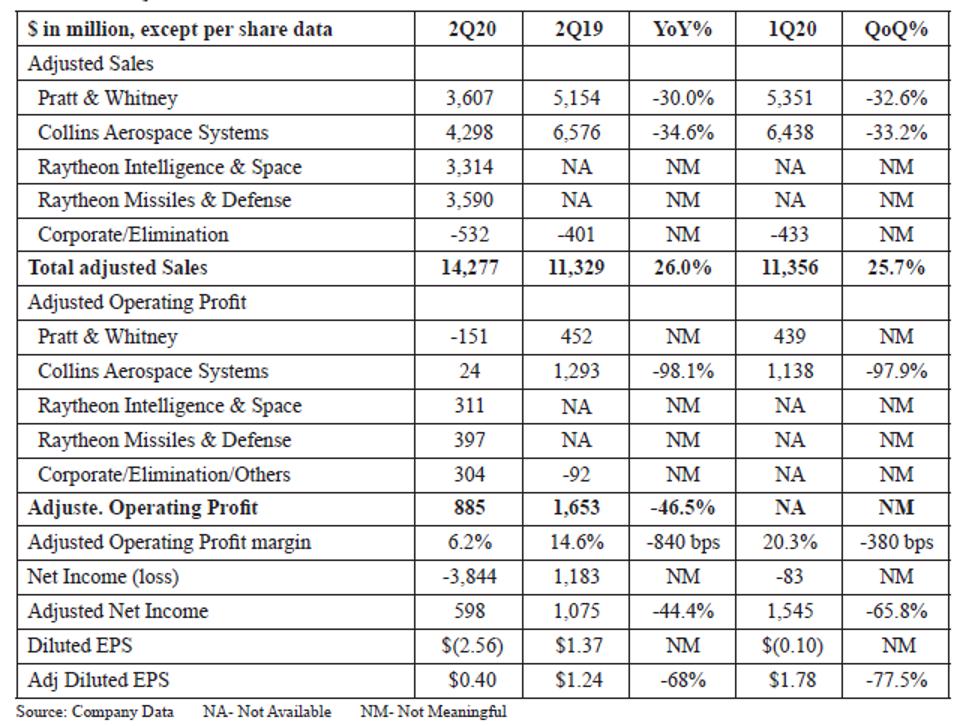

Technologies Corporation (NYSE: RTX, Market capitalization: $86.59 billion), a leading aerospace and defense company, reported robust 2Q20 results, beating the consensus revenue and Adjusted EPS comprehensively. The Company reported an adjusted sales of $14.3 billion in 2Q20 compared to $11.3 billion in 2Q19. However, the 2Q20 sales include legacy Raytheon business sales totaling about $6.9 billion.

The Company reported an operating loss of $3.7 billion in 2Q20 versus an operating profit of $1.4 billion in 2Q19. The decrease in operating profit was primarily due to $3.2 billion in goodwill impairments in the Collins Aerospace business. The adjusted operating profit declined to $0.9 billion in 2Q20, down 46% YoY, as against $1.7 billion, while adjusted operating profit margin decreased by 840 bps to 6.2% in 2Q20.

The Company reported a net loss of $3.9 billion as against net income of $1.2 billion in the prior-year period. In 2Q20, Raytheon reported an adjusted net income of $0.6 billion, down 44% YoY, as against $1.1 in 2Q19. The Company reported adjusted EPS of $0.4 per share, down 68% YoY, as compared to $1.24 per share in 2Q19.

FY20 Outlook

Raytheon Technologies did not provide a traditional outlook due to the ongoing uncertainty regarding COVID-19. However, for Collins segment, the Company expects commercial OE sales to be down in line with OEM production levels and aircraft delivery schedules, and commercial aftermarket sales to be down in line with expected RPM declines and the impact of the ADSB mandate headwinds. For the Pratt segment, the Company expects commercial OE sales to be in line with the main OEM customers, similar to Q2, and commercial aftermarket sales to be down given the more than 50% decline in legacy shop visits. For the military portion of Collins and Pratt, the Company expects to see strength in military sales in mid-single-digit growth. In RIS and RMD segments, the Company did not change the outlook given in the first quarter and still expects RIS and RMD combined sales in the range of $22.1 22.6 billion and operating profi t in the range of $2.4-2.5 billion for the remaining of FY20.

For EPS, the Company expects Q3 to generally be in line with Q2 with some puts and takes, and then a gradual recovery beginning in Q4, as demand begins to return and more of cost actions are realized.

The Company still expects pro forma FY20 free cash fl ow for the full year of roughly $2 billion. This includes an outflow of $1.2 billion to $1.4 billion for merger cost restructuring and cash taxes on dispositions. Also, the Company expects capex spending in the range of $1.5-$1.7 billion. Overall, the Company expects the rest of the year to be challenging for the commercial aerospace segments. However, it continues to expect growth from the defense businesses and positioning the Company for a healthy recovery in the long term.

Other Business Updates

Bookings and Orders – Backlog at the end of 2Q20 was $158.7 billion, of which $85.6 billion was from commercial aerospace and a record $73.1 billion was from defense.

Notable defense bookings during the quarter included:

i) $2.3 billion on the Army Navy/Transportable Radar Surveillance-Model 2 (AN/TPY-2) radar program for the Kingdom of Saudi Arabia at Raytheon Missiles & Defense (RMD)

ii)$1.4 billion on a number of classified programs at Raytheon Intelligence & Space (RIS)

iii)$299 million for Standard Missile-3 (SM-3®) for the Missile Defense Agency (MDA) and an international customer at RMD

iv) In addition, during the quarter RMD was selected by the U.S. Air Force to develop the Long-Range Standoff Weapon (LRSO).

Cost-cutting Plan – The Company’s cost-cutting plan is on track. During 2Q20, RTX reported $600 million of $2 billion planned cost reduction and $1 billion of $4 billion planned cash conservation targets.

Quarterly Cash Dividend – On 6/8, RTX’s Board of Directors declared a quarterly dividend of $0.475 per share, payable on September 10, 2020, to shareowners of record on August 14, 2020.

Collins Aerospace – Collins Aerospace Systems has developed and introduced the only Cabin Air Recirculation high-efficiency particulate air (HEPA) filter installation kit for use on Dash 8 aircraft. The HEPA filter kit mounts inside an aluminum enclosure along with a prefilter and together trap at least 99.97% of the harmful airborne particles that have a diameter of 0.3 micron. These include bacteria, viruses, pollen, dust, mites and other microscopic airborne contaminants in aircraft environmental control systems.

Pratt & Whitney – P&W-powered helicopters, by Pratt & Whitney Canada engines, have proven to be critical assets during the COVID-19 pandemic, providing key support in emergency medical operations and transportation missions.

Raytheon Intelligence & Space (RIS) – Raytheon Intelligence & Space will build two prototype sensor payloads for DARPA’s Blackjack program, under a new contract awarded by DARPA. Blackjack is a low Earth orbit satellite constellation program that aims to develop and demonstrate the critical elements for persistent global coverage against a range of advanced threats. It seeks to track multiple threats simultaneously for the faster and earlier warning for national security.

Raytheon Missiles & Defense (RMD) – Raytheon Missiles & Defense shipped the first three arrays for the Air & Missile Defense Radar (AMDR), to the U.S. Navy during the second quarter. AMDR, part of the SPY-6 family of radars, will provide significantly enhanced range and sensitivity for U.S. Navy Flight III destroyers.

2Q20 Results Review

In 2Q20, adjusted sales came in at $14.3 billion versus $11.3 billion in the 2Q19. The total sales comprise of $3.6 billion from Pratt & Whitney, $4.3 billion from Collins Aerospace, $3.3 billion from RIS and $3.6 billion from RMD. The Company reported an operating loss of $3.8 billion in 2Q20, as compared to an operating profit of $1.4 billion in 2Q19.

However, the Company recorded a goodwill impairment charge of $3.2 billion in 2Q20. In 2Q20, adjusted operating profit declined to $0.9 billion, down 46.5% YoY, as against $1.7 billion, while adjusted operating profit margin decreased by 840 bps to 6.2%. In 2Q20, the Company reported a net loss of $3.8 billion as against net income of $1.2 billion in the prioryear period.

In 2Q20, the Company reported an adjusted net income of $0.6 billion, down 44.4% YoY, as against $1.1 in 2Q19. The Company reported adjusted EPS of $0.4, down 67.7% YoY as compared to $1.24 in 2Q19.

1H20 Results Review

In 1H20, sales increased to $25.4 billion, up 14.1% YoY, as compared to $22.3 billion in the 1H19. The total sales comprise $8.8 billion from Pratt & Whitney, $10.6 billion from Collins Aerospace, $3.3 billion from RIS, and $3.6 billion from RMD. In 1H20, adjusted operating profit declined to $2.6 billion, down 22.2% YoY, as against $3.3 billion, while adjusted operating profit margin decreased by 480 bps to 10%. In 1H20, the Company reported a net loss of $3.4 billion against net income of $1.9 billion in the prior-year period. In 1H20, the Company reported adjusted net income of $1.7 billion, down 19.5% YoY, as against $2.2 in 1H19. The Company reported adjusted EPS of $1.42, down 43.7% YoY as compared to $2.52 in 1H19.

Segmental Information

Pratt & Whitney

In 2Q20, Pratt & Whitney adjusted sales declined to $3.6 billion, down 30% YoY, as compared to $5.2 billion in 2Q19, primarily due to the pandemic’s impact on OEMs and operators. Commercial OEM sales were down 42% YoY, and commercial aftermarket sales were down 51% YoY, partially offset by military sales, which were up 11% YoY.

The decrease in commercial sales was due to a significant reduction in shop visits and related spare part sales and commercial engine deliveries principally driven by the current economic environment. The Company recorded an adjusted operating loss of $151 million for 2Q20, compared to an adjusted operating profit of $452 million in 2Q19. The decrease in adjusted operating profit was due to lower commercial aftermarket sales volume and unfavorable mix.

For 1H20, adjusted sales declined to $8.9 billion, down 10% YoY, as compared to $10 billion in the prior-year period. In 1H20, adjusted operating profit recorded at $0.4 billion, down 61% YoY, as against $0.9 billion, while adjusted operating profit margin decreased by 540 bps to 4.1%.

Collins Aerospace

In 2Q20, Collins Aerospace adjusted sales declined to $4.3 billion, down 35% YoY, as compared to $6.6 billion in 2Q19, primarily due to the adverse impacts of COVID-19 on the aerospace industry. Commercial OEM sales were down 53%, and commercial aftermarket was down 48%, partially offset by military sales, which up 10%.

The decrease in commercial sales was due to the current economic environment, which has resulted in lower flight hours, aircraft fleet utilization, and commercial OEM deliveries. The Company recorded an adjusted operating proft of $24 million, down 98% YoY, from $1.3 billion in 2Q19. The decrease in adjusted operating profit was due to lower commercial aerospace OEM and aftermarket sales volume.

For 1H20, adjusted sales declined to $10.8 billion, down 18% YoY, as compared to $13.1 billion in the prior-year period. In 1H20, adjusted operating profit was $1.3 billion, down 48% YoY, as against $2.5 billion, while adjusted operating profit margin declined by 700 bps YoY to 12.2%.

Raytheon Intelligence & Space

Raytheon Intelligence & Space includes legacy Raytheon Company’s Intelligence, Information, and Services segment and Space and Airborne Systems segment. In 2Q20, the RIS segment reported sales of $3.3 billion. The segment reported an operating profit of $311 million, with a margin of 9.4% in 2Q20. 2Q20 results do not include the RIS pre-merger stub period from March 30, 2020, to April 2, 2020, which had an estimated $200 million of sales and $20 million of operating profit.

Raytheon Missiles & Defense includes legacy Raytheon Company’s Missile Systems segment and Integrated Defense Systems segment. In 2Q20, the RMD segment reported sales of $3.6 billion. The segment reported an operating profit of $397 million, with a margin of 11.1% in 2Q20. 2Q20 results do not include the RMD pre merger stub period from March 30, 2020, to April 2, 2020, which had an estimated $200 million of sales and $25 million of operating profit.

Company Description

Raytheon Technologies (RTX)

Raytheon Technologies Corporation is an aerospace and defense company that provides advanced systems and services for commercial, military and government customers worldwide. It comprises four industry-leading businesses – Collins Aerospace Systems, Pratt & Whitney, Raytheon Intelligence & Space and Raytheon Missiles & Defense. The Company delivers solutions that push the boundaries in quantum physics, electric propulsion, directed energy, hypersonics, avionics and cybersecurity. The Company, formed through the combination of Raytheon Company and the United Technologies Corporation aerospace businesses, is headquartered in Waltham, Massachusetts.