Boeing reported another dismal quarter, helping the company emerge as one of the companies most directly impacted by the global covid pandemic.

For the second quarter Boeing, which said that results are still significantly impacted by Covid-19, reported a 25% drop in revenue to $11.81, badly missing estimates of $12.99 and leading to a $2.4 billion net income loss which translated into a $4.79 loss per share, which while better than the $5.21 per share loss a year ago, was far worse than the $2.54 loss expected as a result of a “slow, uneven” business environment recovery, with defense, government service operations providing stability, but not enough and forcing the company to raise (a lot) of additional debt to bolster liquidity.

As a reminder, Boeing’s best-selling plane, the 737 Max, has been grounded since March 2019 following two fatal crashes. Regulators aren’t expected to clear the planes to fly again before the fall. Separately, the pandemic has driven up financial losses at Boeing’s airline customers and hurt demand for new planes, though Boeing was in crisis even before coronavirus spread around the world.

The company confirmed plans to slow production of its main commercial aircraft as the coronavirus pandemic hurts demand for new planes and its best-selling 737 Max jets remain grounded. Boeing said it would further cut 787 production to just six per month in 2021, the production rate of the 777/777x will be gradually cut to 2 per month in 2021, while it gradually increases manufacturing of its 737 Max to 31 a month by the beginning of 2022, compared with plans to do so next year.

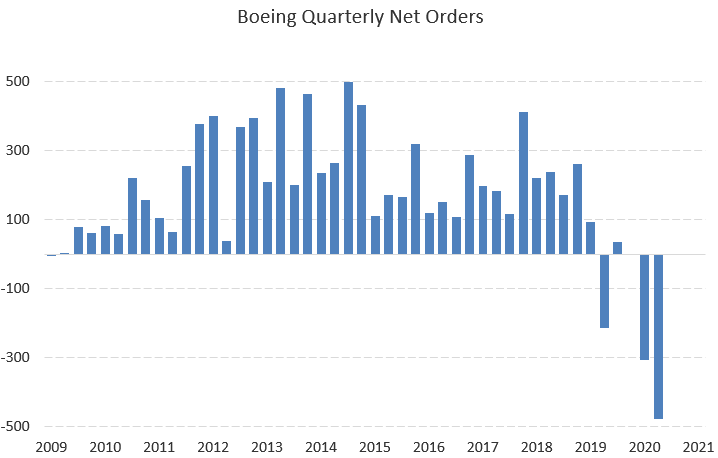

The company is aggressively cutting production as its orderbook has been contracting for the first time in history:

Some more details from the quarter:

- 2Q total commercial planes deliveries 20, down a massive -78% y/y, and below the estimate of 24.40

- 2Q Commercial Airplanes revenue $1.63 billion, estimate $3 billion

- 2Q Defense, Space & Security revenue $6.59 billion, estimate $7.02 billion (need moar wars)

- 2Q Global Services revenue $3.49 billion, estimate $3.29 billion

Even the company’s backlog was hit, dropping 14% Y/Y to just $409BN, a number that continues to shrink by the day.

Some more headlines, which indicate that the company’s buyback – the source of so much joy in previous years and so much pain now – is finally over:

- Boeing Terminated Share Repurchasing Program

- Boeing: Est. Will Take 3 Yrs to Return to 2019 Passenger Levels

- Boeing Says Taking Actions Incl Reducing Employment Levels

- Boeing: We’ll Complete Production of the Iconic 747 in 2022

- Boeing Sees 737 Production Rate 31/Month by Beginning of 2022

- Boeing Global Services Saw $923M Charge on Covid-19 Impacts

- Boeing: Need to Evaluate Most Efficient Way to Produce the 787

Boeing’s CEO Dave Calhoun in April said air travel demand will likely take two or three years to recover. International demand has been particularly soft, hurting the outlook for Boeing’s widebody commercial planes, like the 787 Dreamliner. The International Air Transport Association, a trade group that represents most of the world’s airlines, on Tuesday said it expects passenger air travel demand globally to recover to 2019 levels in 2024, a year later than it previously forecast.

Boeing has more than 470 planes sitting on the ground that haven’t been delivered to customers, most of them 737 Max jets, according to consulting firm Ascend by Cirium. Meanwhile, more than a third of its active fleet is currently parked.

As CNBC notes, Boeing’s CEO Dave Calhoun in April said air travel demand will likely take two or three years to recover. International demand has been particularly soft, hurting the outlook for Boeing’s widebody commercial planes, like the 787 Dreamliner. The International Air Transport Association, a trade group that represents most of the world’s airlines, on Tuesday said it expects passenger air travel demand globally to recover to 2019 levels in 2024, a year later than it previously forecast.

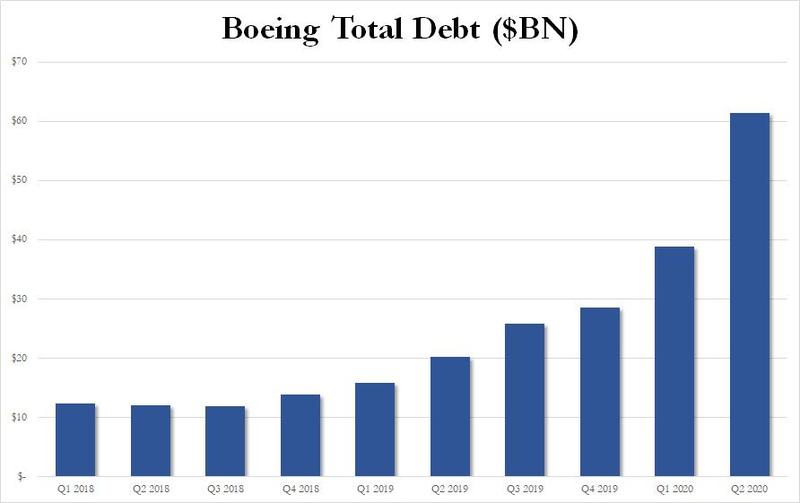

While the income statement was ugly, the balance sheet was downright scary, with Boeing scrambling to load up on as much cash as it could, adding almost $17 billion in liquidity, this was done at the expense of a surge in debt.

crisis. And while Boeing added $17BN in cash, its debt rose even more, surging by over $20BN in the past quarter! It is only a matter of time before Boeing is downgraded to junk.

While Boeing has a lot of cash on its balance sheet to weather the storm, it has yet to end the 16-month grounding of the 737 Max and the pandemic’s devastation of air travel means the planemaker’s recovery will take years.

Yet despite the dismal results, Boeing’s shares were trading higher on the results, up more than 1% in premarket trading as investors focused on one sliver of positive news: that cash burn wasn’t as bad as they feared. As context, the company burned more than $5 billion in the quarter!