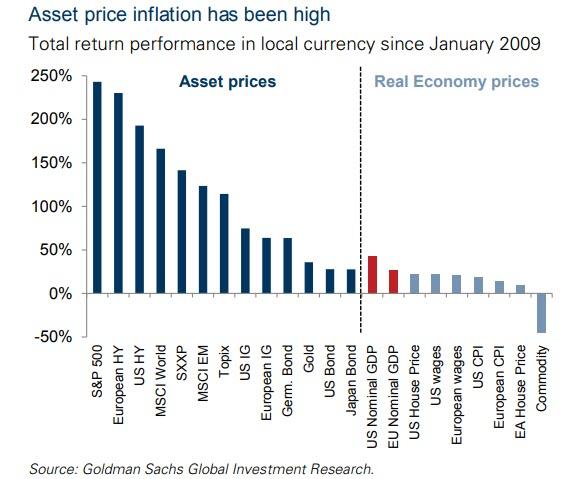

Federal Reserve remains unable to stoke inflation (because it refuses to measure it correctly) and refuses to factor in asset price inflation.

It has now considered launching a new rule that would let inflation run above its 2% target to make up for lost inflation, reported the Financial Times.

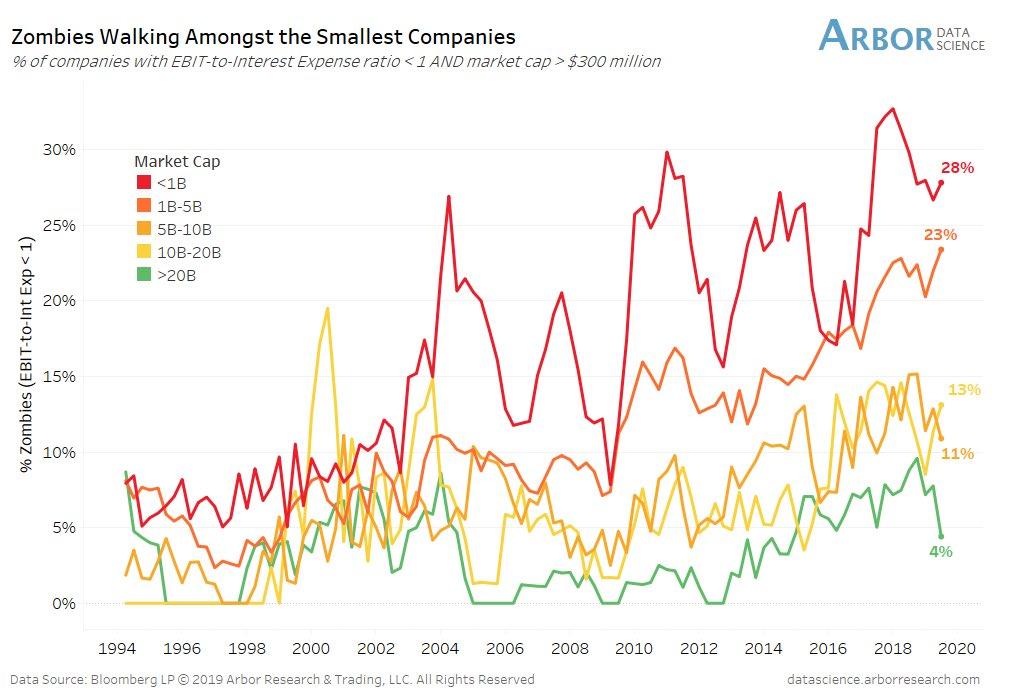

Though the Fed’s policies are to protect big Wall Street banks and keep liquidity ample in the financial system, its policies have overwhelmingly created deflation through supporting zombie companies and blowing financial bubbles.

So to “make up” for lost inflation, the Fed will temporarily increase the target range above 2%, also known as “symmetric” overinflation. The policy would “make it clear that it’s acceptable that to average 2 percent, you can’t have only observations that are below 2 percent,” according to Eric Rosengren, president of the Federal Reserve Bank of Boston, who recently spoke with FT.

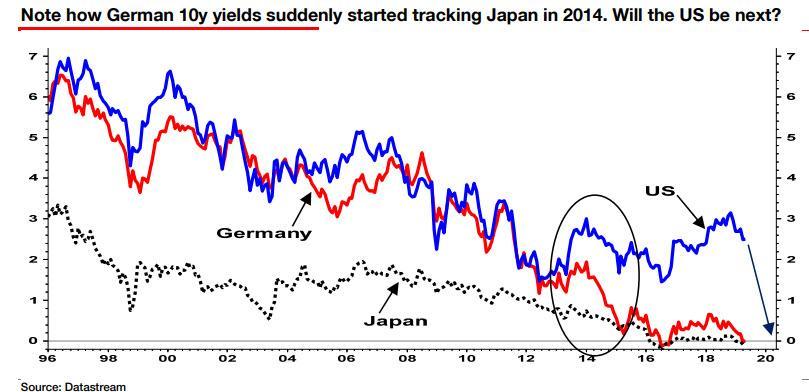

Fed members have expressed concerns that reverting the federal funds rate to the zero lower bound will drive inflation expectations lower, a real risk of Japanification, something Albert Edwards is especially concerned about.

Officials have also lamented that the since the fed funds rate is so low compared to history, any recession could make monetary policy ineffective, though there is always the reality that the Fed will merely unleash negative interest rates during the next recession.

Meanwhile, Fed members have been experimenting with new monetary tools ahead of the next downturn. Janet Yellen said the new rule could be like “forward guidance,” which enabled the Fed to pressure short-term interest rates lower. This eventually allowed longer-term rates to fall as well.

Rosengren said, “future committees might not be as comfortable with that formulaic approach. This is why I prefer something that is a little bit more flexible, maybe not as constraining, but makes it a little clearer that we should be having [some inflation readings] over 2 percent.”

Fed governor Lael Brainard, spoke with reporters last week, said the new rule is to complex to elaborate on with the public. She said if inflation drops, the Fed should allow inflation to run hot, perhaps in a range of 2 to 2.5%.

In plain English, the Fed is afraid that its its own policies are Japanifying the US economy and in response is willing to… drumroll… double down which will somehow push inflation run above target, when in reality it will simply unleash even more deflation!

The strategy clearly shows the Fed is making up policy as it goes ahead of the next recession, where monetary policy will be less effective than ever before. The silver lining: risk prices will be at all time high as the world careens toward the next global recession.