General Electric Co. reported a second-quarter loss and flat sales, but said it was making progress in restructuring its long-struggling and hopeless Power division and raised its full-year financial projections.

GE also said its CFO Jamie Miller, will be leaving her role and the company is beginning a search for a replacement. Ms. Miller, who has been CFO since October 2017, will stay in her role during the transition, the company said.

The conglomerate now expects adjusted cash flow for 2019 ranging from negative $1 billion to positive $1 billion, an improvement from previous guidance of negative cash flow of as much as $2 billion from its core industrial operations.

Cash is in focus for management and investors as the company has cut its dividend twice in recent years stemming from deep problems in its Power business and financial-services division. In the second quarter, GE reported negative $1 billion in cash flow from industrial operations, at the low end of its own target.

“I’m encouraged by the steady progress we are making,” CEO Larry Culp said in an interview, saying the power business “seems to be stabilizing.”

Mr. Culp said he “made the call” that now is the time for the CFO change and he plans on speaking with “new friends and old” in considering candidates for the job.

The company reduced its production rate of its LEAP engines used in the plane and expects the grounding to cut cash flow by $400 million for each of the third and fourth quarters if the plane remains unable to fly, it said in a regulatory filing.

Meanwhile Boeing recently pushed back the expected first flight of its 777x long-haul jetliner, blaming problems with GE’s new engine for the plane. GE has said it will redesign a part that was wearing out faster than expected.

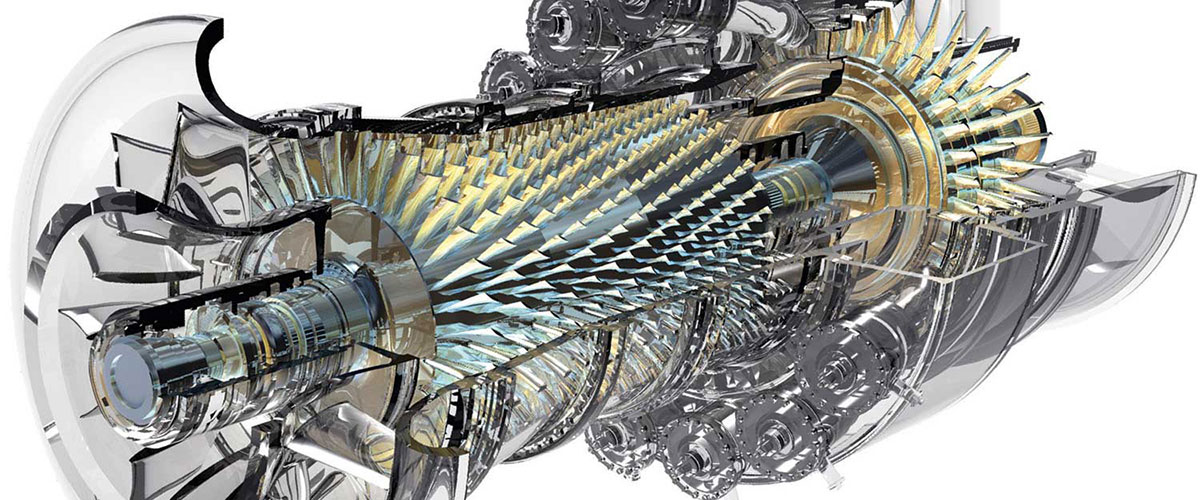

In the second quarter, GE reported a net loss attributable to common shareholders of $61 million, compared with a year ago profit of $615 million. Revenue fell 1% to $28.83 billion, as a sharp decline in the Power division, which makes turbines for power plants, offset gains in Aviation and other units.

GE booked a $744 million pre-tax impairment charge to move some assets from its electrical grid division into its renewable energy division. Excluding that charge and including a 6-cent a share benefit from a tax audit, GE said its adjusted earnings were 17 cents a share, ahead of an analyst projection of 12 cents a share, according to Refinitiv.

GE shares fell 3.4% to $10.16 in morning trading Wednesday. Before the earnings release, the stock had rallied more than 40% this year but was down about 17% in the past 12 months. Two years ago, GE shares traded at close to $25.

The company has positioned 2019 as a “reset year” as its undergoes a restructuring. In the latest quarter, revenue fell 25% at its Power unit and the unit’s profits tumbled. The other major business units fared better, with revenue rising 5% in its Aviation unit, which makes jet engines, and slipping 1% in the health care division, which makes hospital equipment.

GE has been shrinking its finance unit and selling assets to pay down its debt, including cutting a deal to sell its biotechnology business for more than $20 billion earlier this year. In the second quarter, GE raised $1.8 billion by selling half of its 25% stake in Westinghouse Air Brake Technologies, or Wabtec, which merged with GE Transportation this year.

The company will perform a test on its long-term care insurance holdings in the third quarter to see whether it has enough cash reserved for its expected future obligations. Last year, the company had to commit $15 billion in additional reserves for the policies.

Picture: The End of era of big power turbines and centralized electricity production